| Service HGS Investment Group offers: |

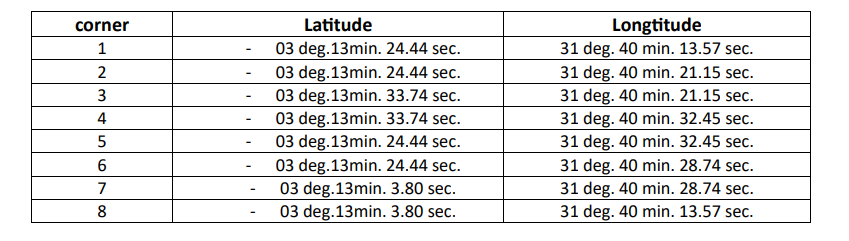

DESCRIPTION OF THE MINING LICENCE AREA

The Area which is, and in respect therewith this Mining Licence apply is at Nampalahala area within geographical District of Bukombe in Bukombe Region, QDS 45/1, defined by the following corner coordinates(Arc 1960) with an approximate area of 0.40 square Kilometres:

Description of minerals deposits:

Description of minerals deposits:

1. Type of minerals

2. Estimated quantity

3. Average minerals grade

4. Estimated recovery rate of ore

5. Proposal for treatment and disposal.

Smentap Gold Mine Progect:

The Smentap Gold Mine Peoject is an advanced development venture situated within the Archean Greanston of the Lake Victoria Goldfields in northwestern Tanzania. This Project holds significant promise due to its strategic location and substantial goldreserves.

Key Project Details:

1. Location:

Approximately 214 kilometers southwest of Mwanza, 42 kilometers east of Geita Gold Mine (AngloGold Ashanti), and 81 kilometers northeast of Bulilalulu Gold Mine (Barrick Gold).

2. Area:

The mining license covers an area of 9.37 hectares.

3. Reserves:

Encompasses the Smentap and Nampalahala deposits, along with other exploration prospects.

4. Permits:

In addition to the mining license, there are numerous prospecting licenses and application surrounding the project.

The Smentap Gold Mine Project has the potential to be become a significant contributor to Tanzania's gold mining industry. Its strategic location, substantial reserves, and advanced development stage make it an attractive investment for mining companies.

The map showcases the project's position within Tanzania, highlighting its proximity to significant urban centers and gold deposits.

Smentap Gold Mine Project - Tanzania

MINERAL Resource Estimate (MRE) as at13 March 2017

| Gold Metal(Moz) | Gold Grade(g/t) | Tonnes(Mt) | JORC 2012 Classification |

| 0.371 | 3.75 | 3.08 | Measured |

| 2.390 | 3.44 | 21.63 | Indicated |

| 2.761 | 3.49 | 24.71 | Sub-Total M & I |

| 0.568 | 3.48 | 5.07 | Inferred |

| 3.330 | 3.48 | 29.78 | total |

- ~83% in Measured & Indicated categories

- MRE Prepared by independent CSA Global

- Extensive Project database includes 2,040 drill holes (237,207m)

- Drill spacing-commonly 40m*40m within MRE

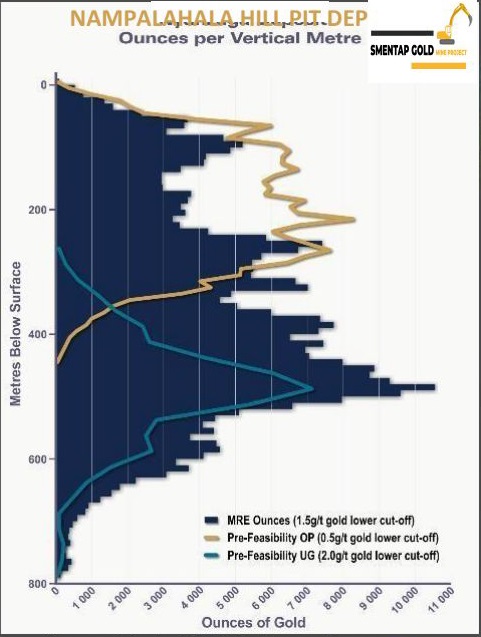

- MRE extends from surface to approximately 800mvertically below surface with mineralisation open at depth

- Whole MRE lies in one deposit

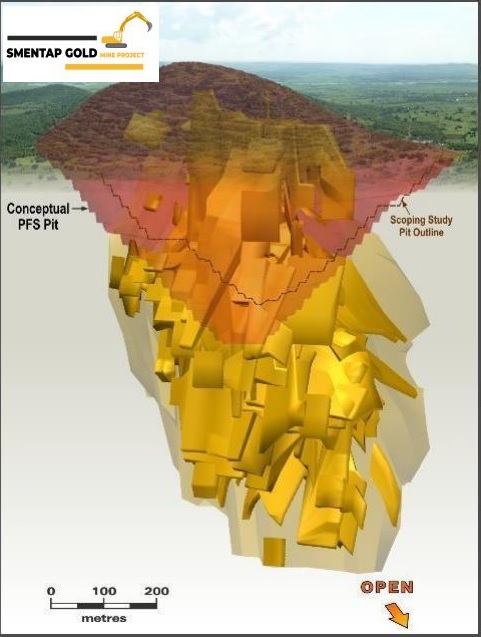

Nampalaha Deposite with Pre- Feasibility Pit Nampalaha Deposite with Pre- Feasibility Pit(Looking South west) |  Nampalaha Hill Pit Deposit averages ~4,200oz per vertical meter Nampalaha Hill Pit Deposit averages ~4,200oz per vertical meter |

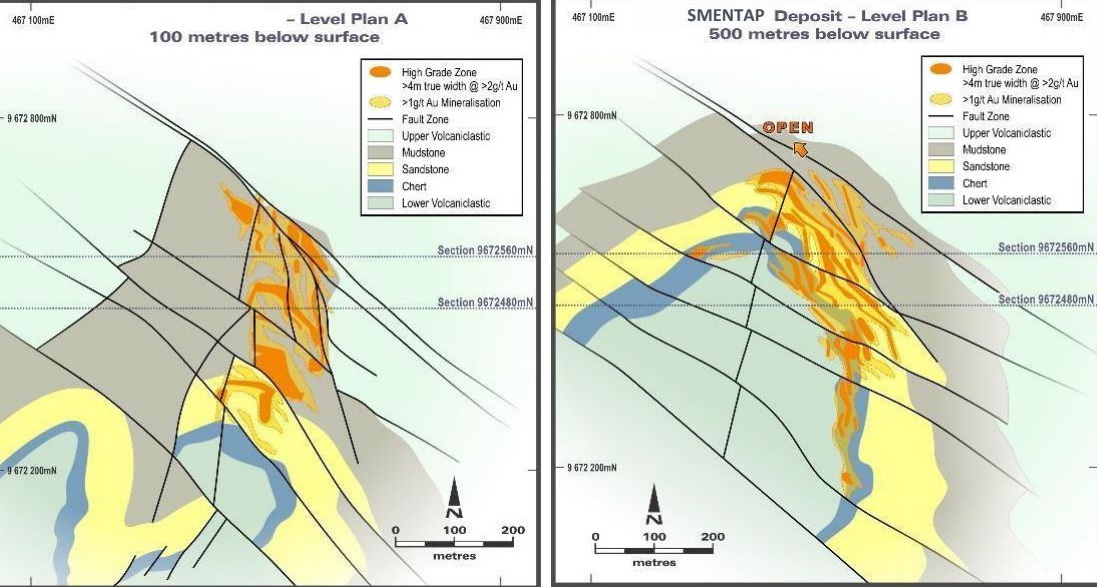

| Level Plan 100m Below Surface | Level Plan 500m Below Surface |

- PFS largele consistent with Scoping Study and further demonstrates potential of Smentap Gold Mine Project

- Average production expected to be 213koz pa over LOM

- Low strip ratio and ~4,200oz per vertical meter creates significant mining flexibility

- Study assume conventional 4Mtpa CIL which delivers 88% gold recovery

- Low risk power and water solutions identified

- Competitive Capital Cost and AISC

- Exploration program commenced to target satellite deposits, enhance economics and increase LOM

- OP is expected to generate 1.75Moz of contained gold, approximately 445m deep

- Average OP feed grade 1.5g/t gold

- ~60% of Samina ounces from OP

- Low strip ratio

- Average strip ratio 3.7:1 (unmineralized material:mineralized)

- Conventional drill and blast, truck and shovel OP mining techniques

- Unmineralized - 400 tonne excavators and 130 tonne trucks

- Mineralized - 350 tonne excavators and 90 tonne trucks

- 10m bench width, 20m bench height

- Mining cost ~US$3.66/t based on contractor mining assumption

- UG development expected to commence in Year 1 of operations

- 1- Capital cost estimated at US$50M (to be funded from operational cash flow)

- 2- Ongoing development capital estimated at US$11M pa

- Steady state mineralised material mining rate anticipated to be 1.0Mtpa (achieved from Year 4 onwards)

- Average diluted grade 3.7g/t to generate 1.16Moz contained gold over LOM

- 2g/t gold lower cut off

- 10% mining dilution

- Access via Boxcut

- 1:7 decline gradient

- Extends 355m below OP

- Average UG mining cost ~US$61/t

- UG mining method open stoping with paste fill

- Established and practiced mining method in the region e.g. Bulyanhulu & North Mara (Gokona) Panels up to 75m high made up of three sub levels and sequenced from bottom up

- 15% of mineralised material from development

- LOM average recovery estimated at 88% through conventional CIL process route

- Relatively hard mill feed

- Closed SAG mill/pebble crusher circuit followed by ball mill

- Material ground to 80% passing 75 microns

- Reagent consumptions within normal ranges

- Pre-production capital estimated at US$6M

- Includes contingency

- Owners costs reflect working capital including; land owner relocation, first fill inventories & site vehicles

- Infrastructure capital assumes power requirement of 31MW with construction 1 of a ~35km power line to grid power

- US$10M budgeted for initial tailings storage facility

- Competitive capital intensity of US$1,346/oz annual production

- Tanzanian electricity grid expansion

- Increasing to 3,000MW from 1,750MW

- 8km transmission line to be constructed to site

- Good site access

- Low topography

- Established regional sealed road network

- Access to water from Lake Victoria

- Located 55km north east of the Project

- Well established regional mining industry with both OP and UG operations

- Logistical supply chains for equipment and consumables

- Skilled personnel for rapid local scale up of on ground 1 activities

Key areas of DFS focus include:

- Finalise metallurgical testwork to further enhance gold recovery and optimise reagent consumption rates

- Conduct geotechnical drilling programme to optimise pit wall angles

- Optimisation of OP and UG mine designs

- Assess contractor vs owner operator mining scenario

- Testwork to confirm paste backfilling

- Upgrade the classification of the current MRE, resulting in an Ore Reserve

- Lake Victoria Goldfields is a major gold producer

- ~20Moz historical gold production

- 40Moz of gold reserves & resources within 100km radius 1 of Samina

- Project comprises 27 Prospecting Licences covering 271km²

- Highly prospective Archaean greenstone terrain

- No artisanal miners on the Samina Deposit

- Initial focus on the potential to add shallow high grade ounces proximal to Samina to supplement baseload feed

- Regional soil sampling program delineated 20 distinct gold-in-soil anomalies;

- 10 new previously undefined anomalies

- Peak gold-in-soil value of 4.96g/t gold

- 6 anomalies have strike extents of >1km

- 11 anomalies untested by drilling

- Soil results will be integrated with aeromagnetic interpretation to prioritise targets for drill testing

- Significant mineralisation from surface and shallow depths

- Drill intercepts up to 16m down hole width

- Peak gold value of 5.35g/t gold over 4m

- Mineralisation confirmed over a 250m strike

- Mineralisation is open down dip & along strik

- Better drill intercepts include:

- BULRC001 - 16m @2.84g/t gold from 48m, including 8m @ 4.01 g/t gold from 56m

- BULAC026 - 8m @ 1.51g/t gold from 24m

- BULAC024 - 4m @ 1.10 g/t gold from surface

- Government engaged and responsive

- Smentap considered a nationally significant development for Tanzania

- Local community extremely supportive of Smentap Gold Mine Project

- Good levels of local employment, set to increase during development

- IP survey at Anomaly 5 revealed a significant chargeability and conductivity anomaly

- Drill intercepts up to 31m down hole width with peak values of 1.34% Ni and 1.29% Cu

- Sulphides are pyrrhotite with subordinate chalcopyrite (copper sulphide), pentlandite (nickel sulphide) and pyrite

- MLEM survey identified late time channel anomaly

- Two conductor plates defined

- Indicates potential sulphides within bedrock

- Drilling commenced

- Assays pending

- Tanzania is the third largest gold ,OGNOC producer in Africa

- * 40°E Fraser Institute Rating - Tanzania 8th most attractive for investment out of 30 African countries in 2014

- 30% corporate tax &4.3% royalty

- Revised Mining Act (2010)

- Stable democracy

- English law and language

- New Heaven Mine Tech $ Supply team has over 20 years experience in Tanzania

- Tanzania - Total area of 947,300km2

- Tanzania is a Republic, administered under English common law in 30 Regions

- ~52 million people, with a 2.8% annual population growth rate

- Christian 61%, Muslim 35%

- Life expectancy of 62 years

- 32% of the population is urban

- GDP per capita si US$3,100, derived from: agriculture - 25.1%; industry - 27.6% &services - 47.3% (2016 est.)

- Electricity generating capacity of ~1,750MW of which 66% is hydroelectric and the rest from fossil fuel

| For more information about this project and personalized investment consulting in Tanzania, please contact us. Our team of experts is here to provide detailed insights and guidance to help you make informed investment decisions. | +989928374806 :whatsapp info@hamongostarsepanta.ir |

Specialized information and local contact number |

Fateme Shakeri